Opening a Bank Account in Japan

It goes without saying that if you live and work in Japan, you're going to need a bank account. Even if you prefer to stuff your cash under your mattress, having a bank account (in Japan) is indispensable for daily life, such as receiving salary and paying utility bills.

This article assumes that you are here on a visa that enables you to stay for more than 6 months (and that you plan to stay longer than 6 months). It is possible to open a Hikyojū-sha enyokin (非居住者円預金) or "non-resident yen deposit" account if you will be staying less than 6 months but longer than 3 months.

Notwithstanding the proliferation of various e-pay applications, Japan is still largely considered a cash society. So, you can forget about opening a chequing account. Cheques simply are not used in Japan. However, transferring money is very simple, and inexpensive, via ATM machines, or these days online.

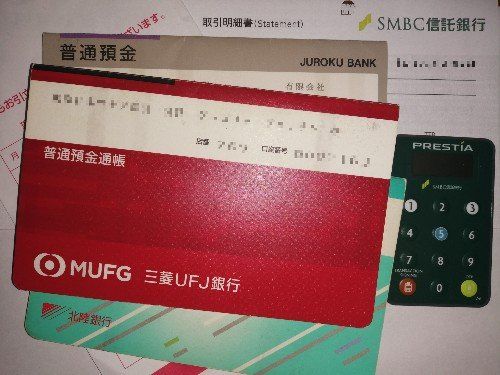

You will most likely be opening a futsū yokin (普通預金) or "regular deposit account".

You will be hard pressed to find a bank where you can go through the process of opening your bank account in English, especially if you are in a more rural area. Invariably, the paperwork will be all in Japanese anyhow, so it's best if you have someone with you proficient in the local language. Most expats with the required visa will probably have either an employer or a spouse/partner who can go to the bank with you. If not, there are support services for expats that will assist in such matters.

What You'll Need to Open Your Bank Account in Japan

The documentation required can differ from bank to bank, but here is what you will typically need. The more you can gather and prepare, the less likely you are to have problems or delays.

These days, many of the online options (which are very legitimate) require minimal documentation (especially if you have a cell phone from a Japanese carrier).

- Valid ID

- Proof of Residency Status

- Fixed Address in Japan

- Japan-based Phone Number

- Employment/Student Info

- Hanko (name stamp)

Valid ID

(and proof of residency status)

- Passport

- Residence Card (zariyu card)

- National Health Insurance Card

- Driver's License (issued in Japan)

- "My Number" Card or Certificate

Proof of Address

The above-mentioned ID may include your address. However, a copy of a recent utility bill (in your name) may also serve as proof of address.

(The author of this article was permitted to submit the envelope of a letter from Grandma addressed to the grandchild as proof of name for purposes of displaying the English name on a Japanese passport. So, documents need not be "official" in all cases.)

Telephone Number (in Japan)

Some banks strictly require having a Japan-based telephone.

When applying online, and doing so via a smartphone app, the requirement to submit additional ID is usually reduced.

Vocational Information

The bank may require validation of your employment or student status.

- Certificate of Employment or Business Card

- Student ID card

Hanko Seal (Japanese Personal Stamp)

It is becoming common for some banks to drop this requirement. However, bring it if you have it. And certainly check with your chosen bank ahead of time.

Expat Friendly Bank Options in Japan

Here are a few of the most popular banking options among expats in Japan.